Indonesia's Election Landscape

The world's third largest democracy is holding its general election on February 14. In the last few days leading up to this date, Prabowo Subianto has strengthened his position as a frontrunner. His running mate and the President’s son, Gibran Rakabuming, has seemingly brought the “Jokowi effect” in pushing Prabowo forward on the coattails of Jokowi's strong approval ratings. The projected runner up is now held by Anies Baswedan, a notable shift from the third quarter, when Ganjar Pranowo held the second spot. A CSIS study noted that the recent debates had influential effects on swing voters and undecided voters.

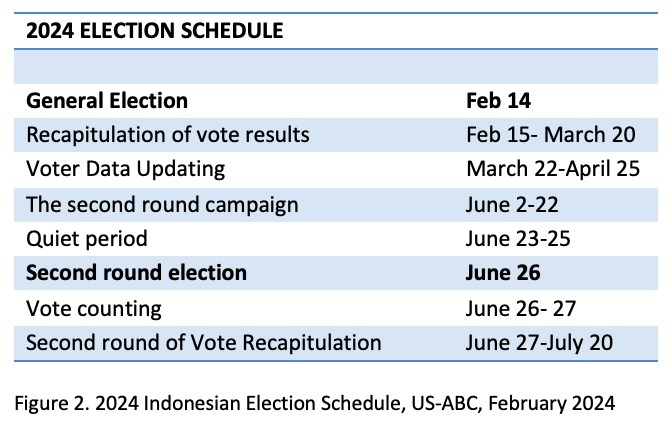

The five presidential & vice presidential debates and campaign rallies have shifted public opinion in favor of Anies (see Figure 1) who has effectively positioned himself as an opposition figure, criticizing Jokowi’s programs and Prabowo’s human rights violation records. Yet, the aspersions have not changed Prabowo’s leading position. On the other hand, Ganjar’s moderate stance has not appeared to leave a distinct mark amidst the polarized stances of Prabowo and Anies, despite strong performances offering quantified goals and the longest track record in governance among other candidates. A contrasting phenomenon occurs in the overseas quick count from February 10, where Ganjar consistently won abroad including in the US (72.6%), Hongkong (54.2%) and Melbourne(56.7%).

How Candidates Differ on Macroeconomic Issues during the Debates

During the debates, all candidates pledged to uphold Indonesia’s nonaligned foreign policy amidst the US-China tensions. Nonetheless, Prabowo and his coalition’s business relations with China is seen as a favorable stance, despite his come back into the US as a Defense Minister. Ganjar’s extensive portfolio of managing both American and Chinese investments, including energy projects in Cepu and manufacturing in Tegal and Batang, has set him in a neutral middle ground. Whereas Anies’ American education background and his plan to reevaluate major projects such as the new capital and high-speed railway, largely funded by China, has further diverged himself from Prabowo.

During the vice-presidential debates on economic growth Gibran ensured continuity of Jokowi’s projects including the national downstream industry and tax base expansion. Muhaimin outlined an inclusivity plan through progressive taxation, informal sectors, and social assistance. Mahfud notably stressed the importance of eradicating corruption to support sustainable growth. Regarding the investment environment, similar to the Prabowo-Gibran campaign, Anies and Muhaimin aim to increase investment certainty through Omnibus Laws. The Ganjar-Mahfud ticket has further emphasized the importance of the rule of law to resolve conflicts of interest hindering investment, along with strict enforcement to address digital data misuse.

When discussing foreign trade agreements, Muhaimin and Mahfud outline similar strategies to enhance economic diplomacy and trade internationalization – suggesting enhanced global trade and partnerships. Gibran continues to emphasize domestic growth via downstreaming capacity, a strategy focused efforts to catch up to competitors in terms of industrial development readiness. It's worth noting that during the US-ABC election briefings, Ganjar's team presented 21 priority commodities for downstream industry development, mirroring Prabowo's approach. Meanwhile, Anies' campaign has criticized Jokowi's nickel downstream development as an environmental threat and advocated for lithium as an alternative for EV batteries.

What to Expect After the February 14 Election

As of today, many surveys have indicated that Prabowo’s electability is surpassing the 50% threshold that he needs to get a single-round victory. While the chance of runoff is getting smaller, it still may occur. Within five days prior to the election there are still 4.5% undecided voters and a 2.9% margin of error, and this number could represent a potential shift in numbers. Moreover, the 50%+1 winning formula is not the only criteria. Prabowo also must gain 20% minimum victory in each of 20 provinces.

Recently, a new wave of opposition to the incumbent has been emerging as the General Elections Commission (KPU) was found to guilty of ethics violations surrounding Gibran’s nomination. Major universities has voicedconcerns about the state of democracy and a new documentary “Dirty Vote” exposing election frauds was released over the weekend. The “four-finger” movement is urging voters to unite behind candidates No. 1 (Anies), or No. 3 (Ganjar) to save the future of democracy. Nevertheless, with a 80% approval rating, the “Jokowi effect” plays a big role, making it appear that these resistances have not significantly moved the needle, especially in the small towns and rural areas that make up the majority of voters.

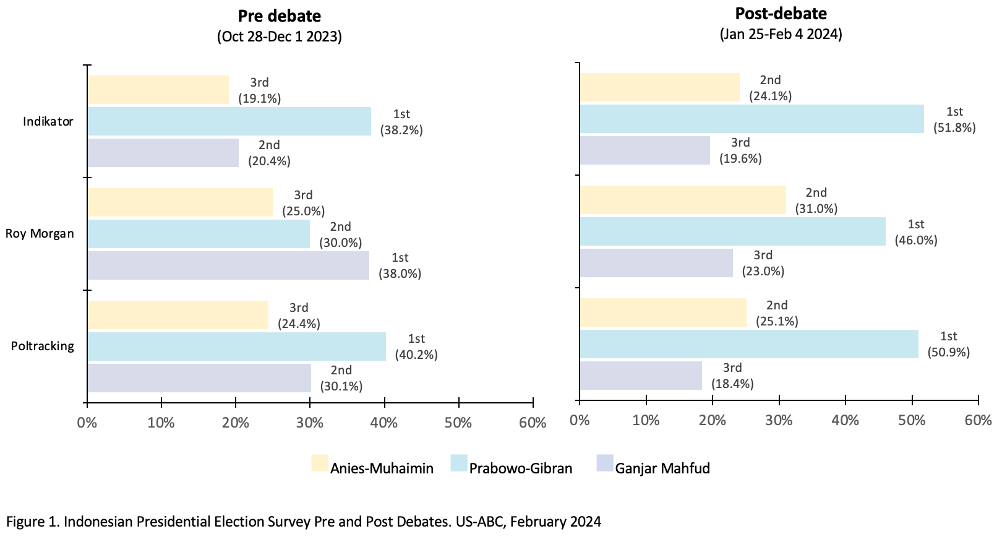

In the scenario where there is a second round of voting, LSI forecast suggests that if Prabowo faces either Anies or Ganjar, he will still be favored to win by over 60% of the vote. On March 20 the official tally will confirm whether there will be a second round of election (See Figure 2). However, from the quick counts, Indonesia will likely learn about the outcome on same day as the election. Then the next question arises: who will the candidates form a coalition with in next round?