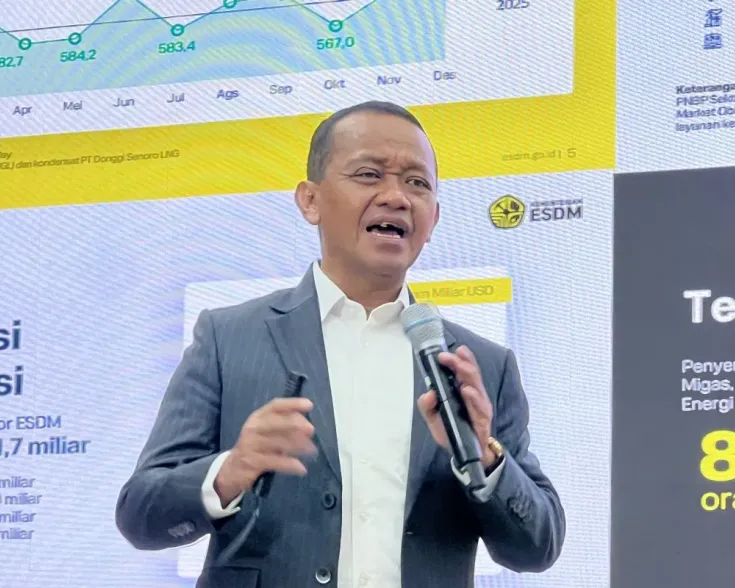

Financial Markets in Indonesia Rebound: Rally or Risky?

The Indonesian government launched a $1.5 billion stimulus package to boost spending by 5% in Q2 as a response to the recent period of deflation in the local economy. Shifting from the $5 billion planned electricity subsidy, the new package includes additional food assistance for 18.3 million households and doubled wage subsidy for 17.3 million workers and teachers. It covers 30% off train tickets, 50% off sea transport fares, 20% off toll fees, 50% off work accident insurance premiums for labor-intensive sectors, as well as a 6% VAT exemption on airfares and a US$430 subsidy for electric motorcycle purchases.

The first quarter of 2025 revealed Indonesia’s slowest GDP growth in three years—4.87% year-on-year—indicating structural headwinds, sluggish exports and weaker household spending. So far, government debt increased by 164% to $21.4 billion, compared to the same period last year, pushing debt to a projected 40.7%, above the 40% medium-term target. The rise is largely driven by Prabowo’s flagship programs likes the free lunch initiative. Still, the 2025 state budget deficit remains contained at 0.13% of GDP, still within the 2.53% target.

However, the stock market recently signalled a more bullish sentiment by investors following the Bank Indonesia’s higher GDP growth forecast from 4.6% to 5.4% (higher than World Bank’s 4.9% forecast). The shift in monetary policy such as stimulus and interest rate cut shows an effort to stimulate economic growth and restore consumer confidence, even as questions persist about government spending. Meanwhile, inflation remains within BI’s target range and the rupiah has regained approximately 4% after hitting an all-time low in April. Moreover, Indonesia’s 2025 state budget (APBN) outlines a cautiously optimistic fiscal trajectory despite softening economic signals and uncertainties due to trade, tariffs and decreased spending.