Vietnam's Revised National Power Development Plan 8 - Ambitious Renewable Energy Targets

In less than two years after the announcement of Vietnam’s National Power Development Plan 8 (PDP8) under Prime Minister Decision 500/QD-TTg in May 2023, Deputy Prime Minister Bui Thanh Son signed Decision No. 768/QD-Ttg on April 15, 2025, approving the amendment of the National Power Development Plan for the period 2021–2030, with a vision toward 2050 (Amended PDP8).

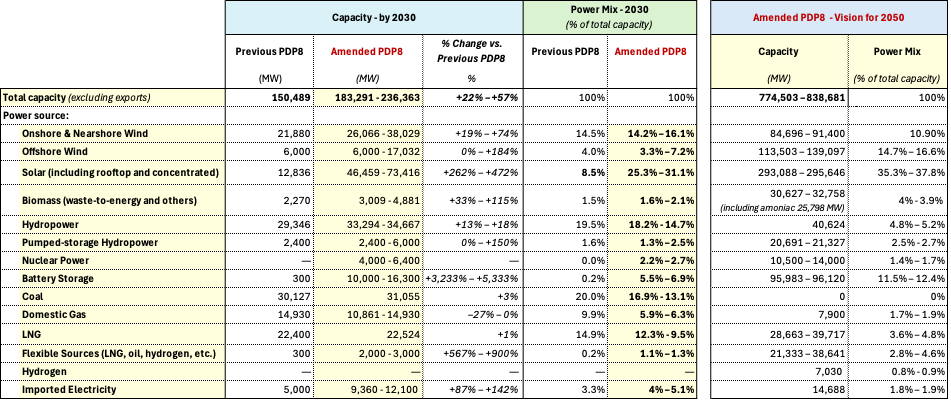

The amended PDP8 is expected to support Vietnam’s economic growth by ensuring a stable and reliable energy supply, aligned with the Government’s targeted annual GDP growth of 10% for the 2026–2030 period and 7.5% for the period from 2031 to 2050. To accommodate this projected growth, overall power generation capacity has been increased by approximately 22%–57% by 2030 and 46%–58% by 2050 compared to the original PDP8.

Notably, the amended plan significantly increases the share of renewable energy in Vietnam’s power mix, prioritizing solar and wind, and for the first time, incorporating nuclear power—further reinforcing Vietnam’s continued commitments to its net-zero emissions targets by 2050.

The amended PDP8 outlines key national power generation and grid projects, including prioritized projects in wind, solar, and LNG, among others (Annex III). It also revises the provincial project allocations established in the original PDP8 and adjusts the planning timeframe from 2021–2030 to 2025–2030, with an extended outlook through 2031–2035.

Shift in power generation capacity and energy mix:

The amended PDP8 introduces a more flexible approach to power generation planning by setting target ranges rather than fixed capacity figures. The plan reflects a notable shift towards renewable energy sources, reducing the reliance on conventional power sources such as coal and LNG.

Key changes include:

Solar power: Solar capacity (including concentrated and rooftop solar) increases 3.6 to 5.7 times compared to the previous plan, making it the top power source, accounting for 25.3% - 31.1% of the total mix by 2030. The updated plan encourages the development of solar power, particularly rooftop installations, for on-site consumption. Centralized solar power will require storage batteries with a minimum capacity of 10% of the plant’s capacity and at least 2 hours of storage. By 2030, Vietnam aims for 50% of office buildings and 50% of households to use rooftop solar power for self-generation and on-site consumption without supplying to the national grid.

Wind power: Wind power is proposed to become the second-largest power source, with onshore and nearshore wind capacity increasing by 19% - 74% compared with the previous PDP8. Offshore wind now has the potential to reach 17,032 MW by 2030, nearly double from the previous plan. Combined, onshore, nearshore, and offshore wind will account for 17.5% - 23.3% of the power mix by 2030.

Hydropower: Hydropower is proposed to be the third-largest power source by 2030, with an increase of 13% - 18% from the previous plan, and now accounting for 14.7% - 18.2% of the mix by 2030. Its proportion will decrease to 4.8% - 5.2% by 2050 as other sources grow.

Coal: By 2030, coal is projected to be the fourth-largest source of power generation. While its installed capacity shows a modest increase of 3% compared to the previous plan, coal’s share of the power mix declines to 13%–16.9%, down from 20% under the original PDP8. After 2030, only projects already approved and under construction will continue, with the goal to cease the use of coal for power generation by 2050. By 2050, coal will account for 0% of the power mix.

LNG: LNG is expected to be the 5th largest power source, contributing 9.5% - 12.3% of total capacity by 2030 under the amended PDP8, with a slight increase in capacity compared to the previous plan. Between 2031 and 2035, LNG projects such as Long Son and Long An II—both already approved—are expected to begin operations, with the potential for fast-tracking if conditions are favorable.

Under Tables 1 and 2 of Annex III, the revised PDP8 updates several new LNG projects including newly added projects in Table 1 and five reserve development LNG projects for the period 2031–2035, each with an estimated capacity of 1,500 MW, under Table 2. Potential locations for these new projects include Thai Binh, Thanh Hoa, Nam Dinh, Vung Ang, and Quang Binh, which may serve as substitutes for approved projects that fall behind schedule or cannot be implemented.

By 2050, the revised PDP8 envisions LNG power plants co-firing with hydrogen (18,200 - 26,123 MW), LNG power plants fully converted to hydrogen (8,576 - 11,325 MW), and new LNG thermal power plants with CCS technology (1,887 - 2,269 MW).

Nuclear Power: Nuclear power is a new addition to the amended PDP8, contributing 2.2%-2.7% of the power mix by 2030. The Ninh Thuan 1 and 2 Nuclear Power Plants are expected to begin operations between 2030 and 2035, with 4,000 – 6,400 MW. By 2050, an additional 8,000 MW of nuclear capacity is planned to provide baseload power.

Battery energy storage and flexible power sources: The amended PDP8 includes significant increase in battery storage capacity (33 - 54 times more than the previous plan), accounting for 5.5% - 6.9% of the power mix by 2030. Flexible power sources also increase 6 - 10 times compared with the previous plan, supporting grid stability as renewable energy penetration grows. A list of battery energy storage projects is provided in Table 11 of Annex III of the amended PDP8.

Electricity Import: Electricity imports by 2030 are revised upward by 87%–142% compared to the previous PDP8, with Laos and China identified as primary supply sources. Imported electricity is expected to account for approximately 5.1% of the power mix in 2030, declining to 1.8%–1.9% by 2050.

Electricity Export: The amended PDP8 also includes plans to supply electricity generated from renewable sources to neighboring countries. By 2030, exports to Cambodia are expected to reach approximately 400 MW, increasing to 5,000–10,000 MW by 2035 to partners such as Singapore, Malaysia, and others in the region.

Direct Power Purchase Agreement (DPPA): The amended Plan highlights that large consumers, defined as those using 1 million kWh/year or more—currently over 1,500 customers—account for approximately 25% of total electricity consumption. By 2050, participation in DPPA and new energy production is expected to contribute 30%–60% of the total electricity generated from renewable sources.

Table 1: Power generation capacity mix comparison between the Amended PDP8 and the previous PDP8

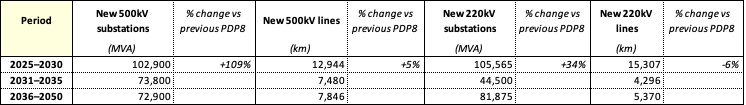

Adjustments in grid development plan:

To accommodate the increase in overall power generation capacity compared to the original PDP8, the grid infrastructure capacity has also been adjusted upward.

Table 2: Grid development plan in the Amended PDP8

The new PDP8 emphasizes the development of a smart grid system to support the integration and operation of large-scale renewable energy installations, while also calling for the research and application of advanced technologies and solutions—such as HVDC, SVC, SVG, FACTS devices, BESS, and DLR.

In the amended PDP8, new developments regarding regional grid interconnection include:

· The implementation of 500 kV and 220 kV transmission lines to import electricity from China to northern provinces by 2030, with studies on interconnection options using either HVDC or UHVDC technology.

Research and application of ultra-high voltage grid interconnections with ASEAN countries to facilitate electricity import and export.

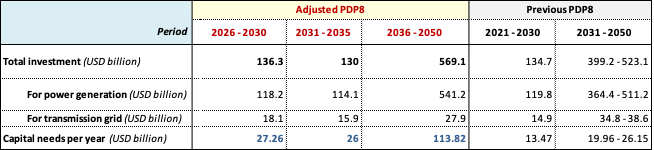

Growth in capital demands:

The amended PDP8 reflects a notable increase in capital requirements to meet its ambitious goals. For the period 2026–2030 alone, the funding needs exceed the total capital required for the entire 2021–2030 period under the previous plan. This results in an annual capital requirement of over US$27 billion through 2030.

Table 3: Comparison of capital demand in the amended PDP8 and previous plan

To address the rapidly increasing capital requirements for power sector development, the amended plan encourages a mix of public, private, and public-private partnership models, with a strong focus on enhancing both domestic and foreign private sector participation.

The plan also calls for a diversification of funding sources, expanding access to international financing through tools such as green bonds, climate credit, and international commitments. In addition to the Just Energy Transition Partnership (JETP), the Asia Zero Emission Community (AZEC) is included in the new PDP8 as a channel for investment. During Prime Minister Ishiba's recent visit to Vietnam on April 28, Japan committed to supporting approximately $20 billion in projects under AZEC, including offshore wind, transmission development, and biomass, with financing from the Japan Bank for International Cooperation (JBIC).

In parallel, Vietnam is intensifying cooperation under JETP, aiming to cap power sector CO₂ emissions at 197–199 million tons by 2030, and potentially as low as 170 million tons through JETP support. To facilitate transparency and investor engagement, the Vietnam government has launched an online platform to share updates on JETP-related policies and projects.

These efforts reflect Vietnam’s broader strategy to mobilize large-scale investment while transitioning to a low-carbon energy future and achieving net-zero emissions by 2050.

![Cover-[USABC-Final]-Driving-ASEAN-Unity-Malaysia's-Vision-for-2025](/sites/default/files/2025-07/Cover-%5BUSABC-Final%5D-Driving-ASEAN-Unity-Malaysia%27s-Vision-for-2025.jpg)