Vietnam’s Robust Trade Performance in the First Seven Months of 2025

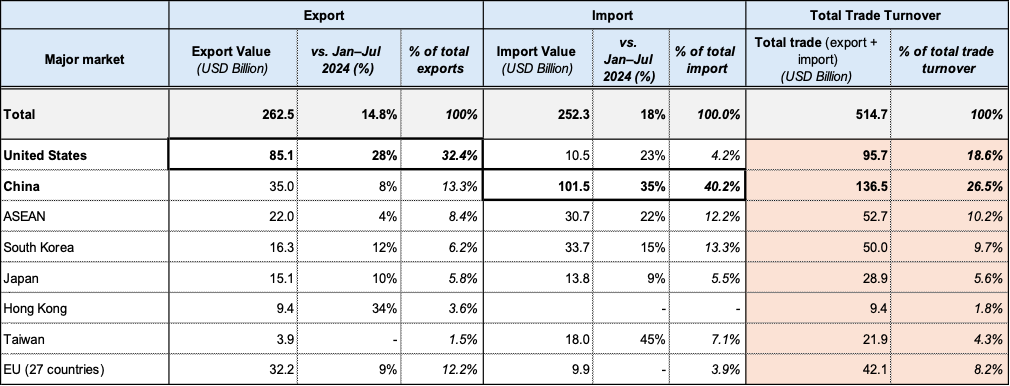

Vietnam recorded impressive trade growth in the first half of 2025 and continued this upward trend into July, as exporters braced for new U.S. tariffs. According to Vietnam Customs, in the first 7 months, total trade turnover reached US$514.7 Bn, up 16.3% year-on-year. Exports amounted to US$262.46 Bn (up 14.8%), while imports reached US$252.26 Bn (up 17.9%), resulting in a trade surplus of US$10.2 Bn.

Foreign-invested (FDI) enterprises continued to dominate Vietnam’s trade, accounting for 70% of total trade at US$362.4 Bn (+20.7% YoY). Of this, exports from FDI firms reached US$194.19 Bn (74% of total export, up 18.4%), while imports totaled US$168.18 Bn (67% of total imports, up 23.6%), generating a US$26 Bn surplus, while domestic firms posted a US$15.8 Bn deficit.

Robust growth was seen across all markets, in both exports and imports. The U.S. remained Vietnam’s largest export market at US$85.12 Bn (+27.9% YoY), making up 32.4% of total exports, while China was the top import source at US$101.45 Bn (+27.2%), or 40.2% of imports. Intra-Asian trade now accounted for over 58% of Vietnam’s total trade turnover.

Source: USABC analysis (based on Vietnam Customs Report)

Trade with the United States:

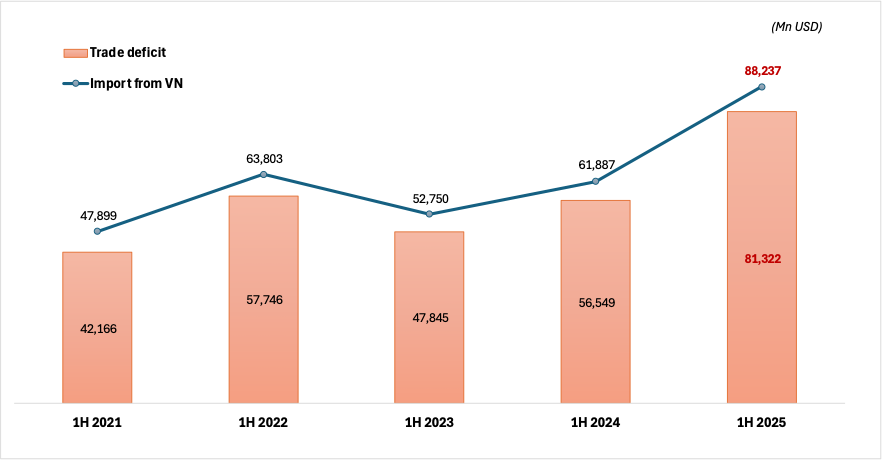

Data from the U.S. Census Bureau show a record surge in imports from Vietnam, totaling US$88.2 Bn in the first half of 2025, a 43% increase year-on-year. The U.S. trade deficit with Vietnam also jumped to US$81.3 Bn, up 44% from the same period in 2024.

Source: USABC analysis (based on United States Census Bureau data)

The surge was largely driven by front-loading of shipments ahead of impending U.S. tariffs. Exporters acceleratedshipments in 1H 2025, with container bookings from Vietnam spiking in the weeks leading up to July 9 as companies rushed to ship goods ahead of higher tariffs. This urgency was evident in key U.S.-bound export categories over the first seven months: computers, electronics, and components soared to US$22.4 Bn (+67.8% YoY); wood and wood products rose to US$5.41 Bn (+10.5% YoY); and toys, sports equipment, and related parts climbed to US$3.02 Bn, more than tripling compared to the same period in 2024, according to Vietnam Customs.

Compared to the initially announced 46% U.S. reciprocal tariff in April, the current 20% rate allows Vietnam to avoid the steepest penalties and eases concerns of being disproportionately hit relative to regional peers. Yet, the framework agreement is still pending, with further negotiations expected through year-end, especially concerning the 40% tariff on transshipped goods. Vietnam’s trade outlook will hinge on the outcome of these talks and its ability to navigate the evolving landscape with strategic agility.