Malaysia’s Critical Minerals MoU with the United States draws Chinese Counter-Proposal

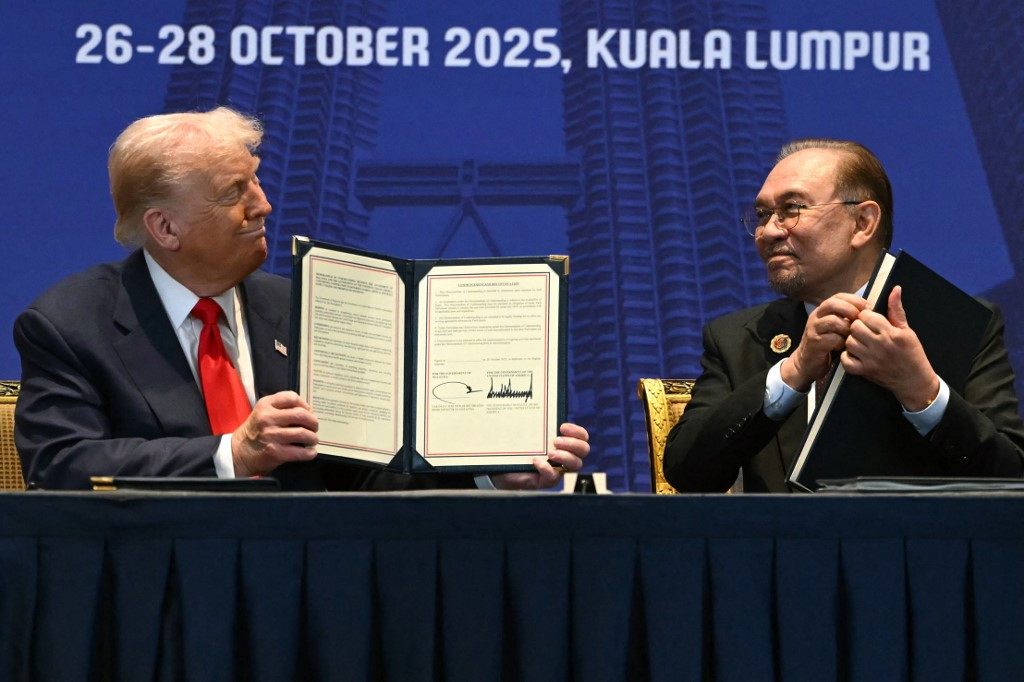

Malaysia’s critical-minerals cooperation with Washington has moved to the center of regional geopolitics following President Trump’s October 26 visit to Kuala Lumpur. During the visit, both governments signed the US–Malaysia Agreement on Reciprocal Trade (ART) and a separate Memorandum of Understanding (MoU) on critical minerals supply chains. According to the Office of the United States Trade Representative (USTR), the ART reduces tariffs and streamlines customs procedures while the accompanying critical minerals MoU focuses on cooperation in exploration, processing, refining, recycling, and supply-chain resilience.

For months, Malaysia’s domestic resource policy has sat uneasily alongside these new commitments. In an October 29 parliamentary session, Trade Minister Tengku Zafrul said Malaysia would maintain its existing ban on exports of raw rare earth elements, arguing that the country must safeguard its 16.1 million metric tons of rare earth deposits and prioritize domestic processing rather than shipping unprocessed ore. Further downstream, Prime Minister Anwar Ibrahim has highlighted a 600 million ringgit super-magnet plant in Pahang, developed by Australia’s Lynas Rare Earths and South Korea’s JS Link, as part of Malaysia’s push to build higher-value rare-earths manufacturing capacity.

China has reacted publicly to the ART and associated MoU. On November 27, China’s Ministry of Commerce said it had “grave concerns” about parts of the US-Malaysia trade deal and urged Malaysia to consider its long-term interests. Beijing has even gone so far as to issue its own MoU with Malaysia that covers “strategic sectors” amid fears that Washington could weaponize higher tariffs in the future, a move they call a “poison-pill” aimed at forcing partners to choose sides.

The US–Malaysia MoU could open clearer paths for US and allied investment in Malaysia alongside stronger regulatory cooperation. At the same time, China’s counter-proposal and its vocal concerns about the ART show that Beijing still views Malaysia as a key node in its own regional supply-chain strategy. In 2026, investors will be watching how Malaysia navigates this situation and whether similar U.S. agreements with other ASEAN economies will deepen the “push-and-pull” dynamics now shaping critical-minerals geopolitics in Southeast Asia.

![Cover-[USABC-Final]-Driving-ASEAN-Unity-Malaysia's-Vision-for-2025](/sites/default/files/2025-07/Cover-%5BUSABC-Final%5D-Driving-ASEAN-Unity-Malaysia%27s-Vision-for-2025.jpg)