Indonesia Assessing Cryptocurrency Mining as a National Reserve Strategy

After Indonesia raised taxes on cryptocurrency transaction, which include increases on income tax from 0.1% to 0.21%, foreign exchanges sales tax from 0.2% to 1% and value-added tax on crypto mining from 1.1% to 2.2%, leading local cryptocurrency-focused community group, Bitcoin Indonesia, was invited to the Vice President office to pitch using Bitcoin as a national reserve asset. As Indonesia is ramping up its AI adoption, the local group proposed to leverage Bitcoin mining, hydropower, and education to drive the nation's economic growth.

Despite the forward-looking vision, rapid growth and tangible potentials presented by the private sector, the Indonesian government is still at an early stage of exploration. The current policy, or lack thereof, still restricts the expansive use of cryptocurrency beyond retail trading and speculation. Although Indonesia’s government continues to take a relatively conservative approach towards cryptocurrencies, continuous public private discussions may signal a willingness to consider a policy change on cryptocurrencies. In addition, crypto payment bans are still in place since 2017, although, recently, the implementation of this ban has reportedly appeared to be “lax”.

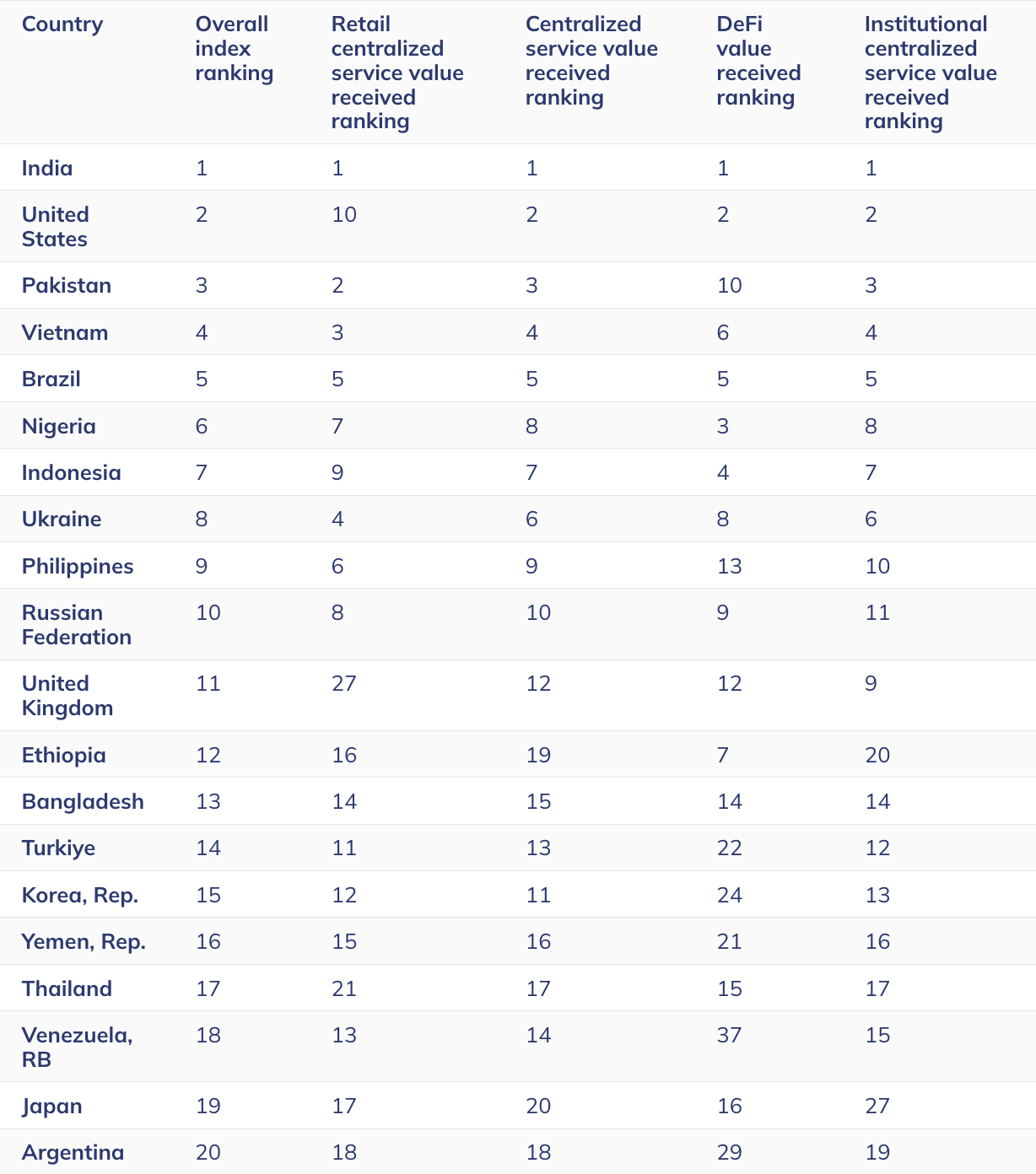

While Asia Pacific is reported to be the region with the fastest growing crypto activities with total transaction volume grew from $1.4 trillion to $2.36 trillion in a year, Indonesia stands out by holding the 7th spot on the 2025 Global Crypto Adoption Index. Measured by grass root implementation and institutional facilitation, Indonesia is superseded by Vietnam (3rd) then followed by the Philippines (9th) and Thailand (17th) on the index. Meanwhile, the United Sates rapidly climbed to the 2nd place, just behind India, up from the 4th place last year. This surge may be driven by the Trump administration’s new crypto policies that, among others, allow spot approval for multiple bitcoin ETFs and expands participation via traditional finance.