Indonesia to Amend Coal and Mineral Policies in 2026

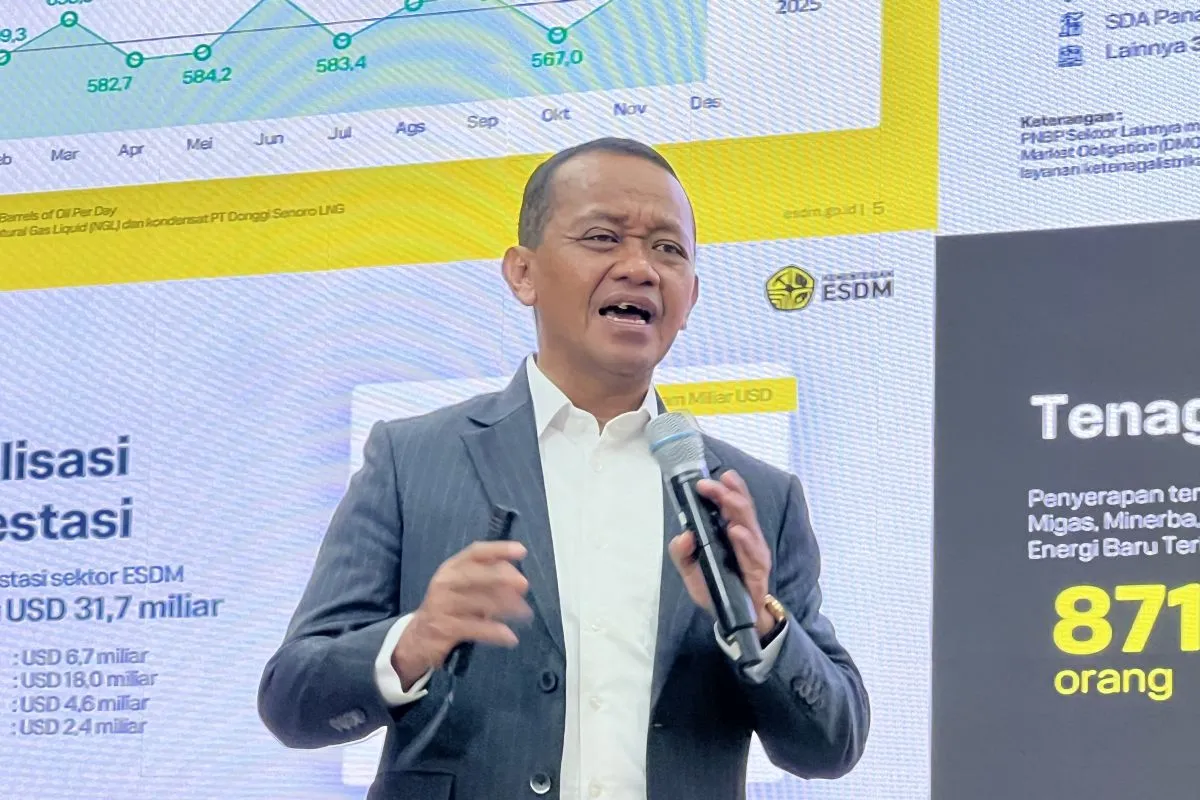

The Indonesian Ministry of Energy and Mineral Resources (MEMR) has announced plans to reduce coal production to approximately 600 million tons in 2026, 200 million tons lower than the 790 million tons produced in 2025. The plan was confirmed by Energy and Mineral Resources Minister Bahlil Lahadalia, who also indicated that the government intends to curb nickel output next year, though the scale of nickel cuts has yet to be finalized. The production cuts are primarily aimed at stabilizing global commodity prices amid persistent oversupply. Global coal trade currently stands at roughly 1.3 billion tons per year, with Indonesia contributing approximately 514 million tons, making it the world’s largest seaborne coal exporter. Indonesia’s benchmark coal price fell to US$103.30 per ton in early January 2026, down sharply from US$124.24 per ton in February 2025. By tightening supply, Indonesia seeks to mitigate downward price pressure in an increasingly competitive market.

Production will be adjusted based on industrial demand to restore price stability and safeguard long-term resource sustainability. To achieve this, the government plans to tighten export volumes while maintaining sufficient domestic supply. Officials have previously signaled an increase in the Domestic Market Obligation (DMO)–––currently set at 25 percent–––for priority industries such as electricity, energy, and fertilizer, while maintaining the fixed DMO price at US$70 per metric ton. Nickel markets have also seen a decline, with prices dropping from US$15,660 per dry metric ton (dmt) in January 2025 to US$14,630 per dmt in January 2026. MEMR has urged major industrial players to source nickel ore from local mining companies, warning against monopolistic practices.

For the U.S. private sector, Indonesia’s supply control underscores growing policy intervention and resource nationalism in global energy and minerals markets. U.S. energy traders and manufacturers that are dependent on Asian supply chains may experience tighter availability and price volatility. LNG exporters, on the other hand, could benefit as coal increasingly functions as a managed transition fuel. Meanwhile, nickel output restrictions increase risks for U.S. companies involved in electric vehicles (EVs), battery, and clean-energy supply chains, highlighting the need for diversified sourcing.