Positioning for Growth: U.S. Business Strategy Amid ASEAN Tariff Shifts

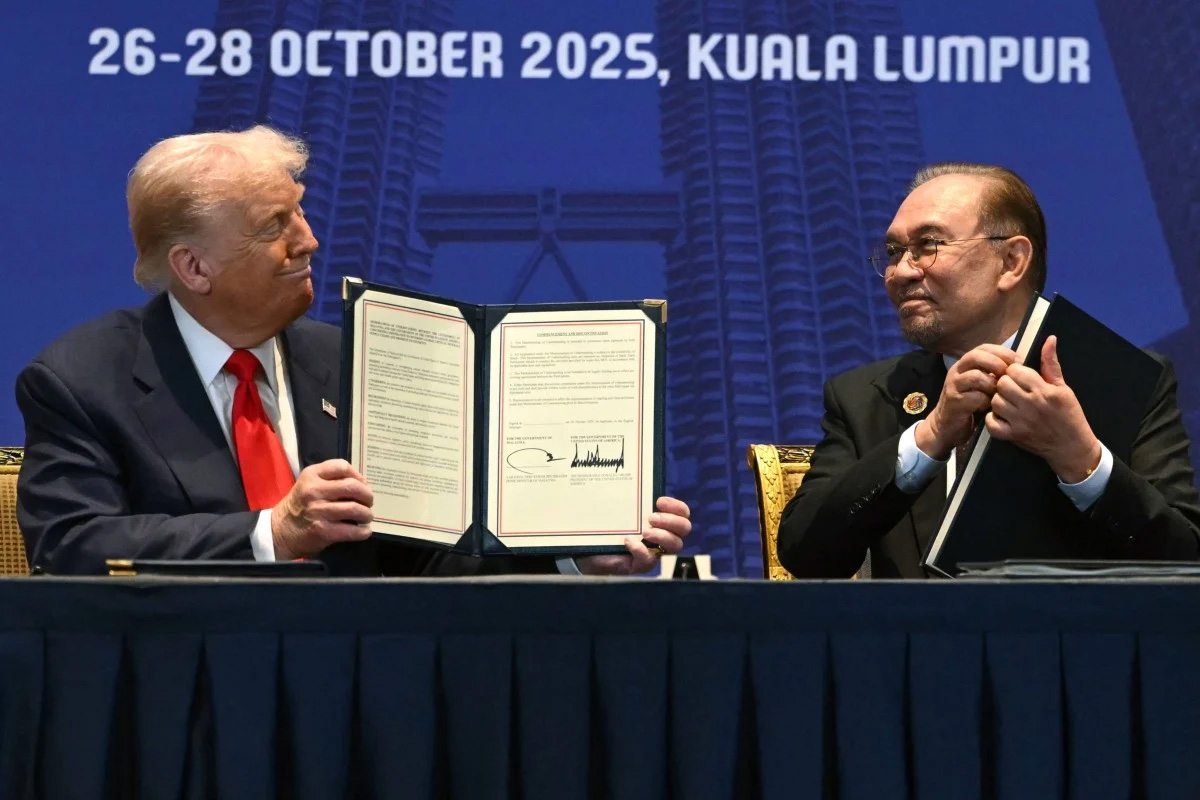

At the 2025 ASEAN Summit, the POTUS signed two final deals (Malaysia and Cambodia) and two framework deals (Vietnam and Thailand), highlighting that reciprocal tariff negotiations with ASEAN countries continue to move forward. Despite U.S. agricultural import tariffs, ASEAN countries’ agriculture industries continue to grow. Vietnam’s global agricultural exports from January to August 2025 reached over $45 billion, up 12% over the same period last year. Cambodia’s global agricultural exports reached $4.18 billion between January and October 2025, a year-over-year increase of 28.5%. As more reciprocal tariff deals are made with ASEAN countries, the region’s agricultural products imported into the U.S. will likely continue to increase under a lower tariff environment.

Under the pressure from rising American consumer prices, the POTUS recently announced US reciprocal import tariff exemptions for over 200 agricultural products, including coffee, tea, certain tropical fruits and spices, and beef. This policy change provides the U.S. private sector some certainty to strategize its supply chain resilience and align with the Trump administration’s goals to bolster U.S. manufacturing and strengthen domestic food production.

The reciprocal tariff framework deals and the final Agreement on Reciprocal Tariffs (ART) with ASEAN governments create both opportunities and challenges. In a rapidly evolving global market, U.S. companies could leverage the current lower tariff environment to adjust sourcing strategies and pricing models, tap into the fast-growing ASEAN markets, build strategic partnerships in sectors like smart agriculture, and maintain competitiveness through domestic food production investments.