Strategic Opportunities and Risks in U.S.–Malaysia and U.S.–Cambodia Reciprocal Tariff Deals

Correction note: Updated details on Malaysia’s and Cambodia’s tariff exemptions.

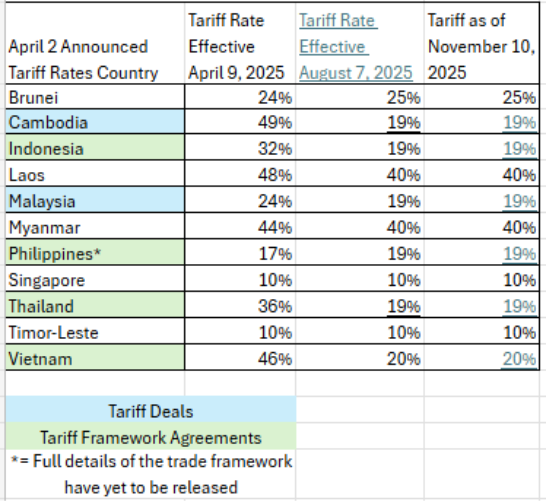

During the 2025 ASEAN Summit, President Trump signed two final reciprocal tariff deals with Malaysia and Cambodia. Both Agreements on Reciprocal Trade (ART) help level the playing field for U.S. businesses by ensuring fair trade terms and setting a 19 percent tariff rate on American importers of goods made in Malaysia and Cambodia entering the U.S. market. The two ART offer details on similar products that are exempt from U.S. reciprocal tariffs (Malaysia’s exemptions list, Cambodia’s exemptions list). For example, certain aircraft components (other than military), pharmaceutical applications (not patented in the U.S.), lumber products (e.g., plywood) and agricultural goods (e.g., coffee, tea, fruit, palm oil) will have a zero reciprocal tariff rate when imported into America.

In mid-November, President Trump also announced that more than 200 food products —such as coffee, bananas, and beef—would be exempt from tariffs in response to concerns over rising consumer prices. These developments highlight the influence of the U.S. private sector and its consumers in shaping tariff exemption decisions. As the list of U.S. tariff exemptions remains fluid, both American businesses and ASEAN governments must account for this uncertainty during the negotiation process for future trade agreements. Although some Malaysian and Cambodian goods may still face other U.S. import tariffs, such as those under Section 232, sector-specific exemptions could bolster investor confidence by improving market predictability and informing strategic planning.

The US-Malaysia ART creates a clearer alignment between the Government of Malaysia’s trade policy and U.S. unilateral export controls, a $70 billion investment target in the United States, and explicit commitments to maintain a level playing field against third-country SOE. The Government of Cambodia, while granting broader rights for U.S. investors in critical sectors on terms no less favorable than domestic businesses and committing to transparency under international law, lacks quantified investment obligations and applies certain commitments “to the extent possible,” introducing potential enforcement variability. Digital trade provisions are largely harmonized, but Cambodia’s approach to data transfer is framed as “free” rather than “with appropriate protections,” which may raise compliance and cybersecurity considerations. For U.S. firms prioritizing regulatory predictability, investment scale, and robust enforcement, Malaysia’s ART offers a more structured approach, while the ART with Cambodia provides flexibility and equal treatment assurances that may appeal to businesses seeking adaptable market conditions.

When these two final deals go into force the removal of import tariffs on American goods and addressing non-tariff barriers should present significant commercial opportunities for U.S. businesses. However, certain provisions still introduce uncertainties that could pose challenges for the U.S. private sector. First, Malaysia’s and Cambodia’s commitments to align with U.S. national security measures—such as export controls, sanctions, and sector investment promotions—introduce compliance uncertainty and operational risk. If these countries interpret “alignment” broadly or apply restrictions inconsistently, U.S. firms could face sudden disruptions in supply chains, particularly for critical minerals, technology components, and infrastructure projects. Second, provisions requiring cooperation on sanctions and entity lists may expose U.S. businesses to reputational or legal risks if local enforcement is weak or politicized, creating uneven application and potential backlash from third-country trading partners. Third, Malaysia’s obligation to adopt equivalent restrictive measures and Cambodia’s case-by-case alignment could lead to retaliatory actions, increasing costs for U.S. companies operating regionally.

Last but not least, the agreements aim to combat transshipment via undefined mechanisms, which would be part of duty evasion cooperation agreements. In addition, if the governments of Malaysia or Cambodia conclude any new bilateral FTA or preferential economic agreements that jeopardizes essential U.S. interests, then the U.S. Government may terminate the agreement and reimpose reciprocal tariff rates under Executive Order 14257 (April 2, 2025). The lack of a defined framework for rules of origin and the broad, undefined scope of “essential U.S. interests” create risks for American businesses, making it difficult to anticipate compliance requirements and assess the longevity of these deals.

In sum, the two trade deals strengthen U.S. economic security alignment, such as reinforcing supply chain resilience, enhancing cooperation on export controls and sanctions enforcement, and establishing mechanisms to combat duty evasion—while simultaneously expanding market access and investment opportunities for U.S. businesses in Southeast Asia. The deals can also risk creating regulatory unpredictability, higher compliance costs, and strained relationships with non-aligned markets—factors that U.S. businesses must proactively manage through due diligence (i.e., tracking necessary customs certificates).

U.S.- ASEAN Reciprocal Tariff Agreements (as of November 10, 2025)