Vietnam Macroeconomic & Trade Update (Q3 and Jan – Oct 2025)

Vietnam’s economic performance continued to strengthen in the third quarter, with GDP expanding 8.23% year-on-year, up from 7.96% in the previous quarter. This marks its strongest quarterly growth since 2011, excluding the post-pandemic rebound in 2022 and reinforces Vietnam’s position as the fastest growing economy in ASEAN during the period.

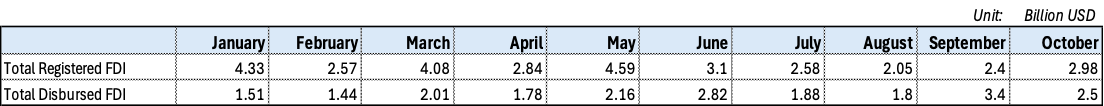

Foreign direct investment (FDI) remains a central pillar of Vietnam’s growth narrative. According to the latest government data, the first ten months of 2025 recorded USD 31.52 billion in registered capital, an increase of 15.6% compared with the same period last year. Disbursed capital reached USD 21.3 billion, up 8.8% year-on-year. Both metrics have already reached roughly 84% of their full-year 2024 levels, making this the strongest ten-month performance in five years. While monthly inflows softened from June through August, commitments began to recover through September and October—a sign of renewed investor confidence.

Monthly FDI to Vietnam (January – October 2025)

Manufacturing and processing continued to dominate newly licensed FDI with USD 7.97 billion, representing 56.7% of total commitments. Real estate activities followed with USD 2.75 billion (19.5%), while other sectors collectively accounted for USD 3.35 billion. Among the 87 economies with new investment projects during the period, Singapore remained the largest source of newly registered capital at USD 3.76 billion (26.7%), followed by China, Hong Kong, Japan, Sweden, and Taiwan.

Trade Surges Toward Another Record Year

Trade performance also remained robust, positioning Vietnam to surpass last year’s record-high levels. In the first ten months of 2025, total two-way trade reached USD 761.9 billion, equivalent to 97% of the value recorded for all of 2024. Exports totaled USD 390.7 billion, while imports reached USD 370.2 billion. The FDI sector continued to anchor the export profile, accounting for 75% of export turnover during the period. Product composition remains broadly consistent with last year: computers, electronics, phones, components, machinery, and equipment collectively represented 47% of exports and 45% of imports, underscoring the continued strength and diversification of Vietnam’s export base.

Bilateral Trade with the United States

On October 26, the United States and Vietnam reached a Framework Agreement on Reciprocal, Fair, and Balanced Trade, and negotiations are ongoing to finalize the details. The most recent round of ministerial-level discussion took place during the week of November 10 in Washington, D.C.

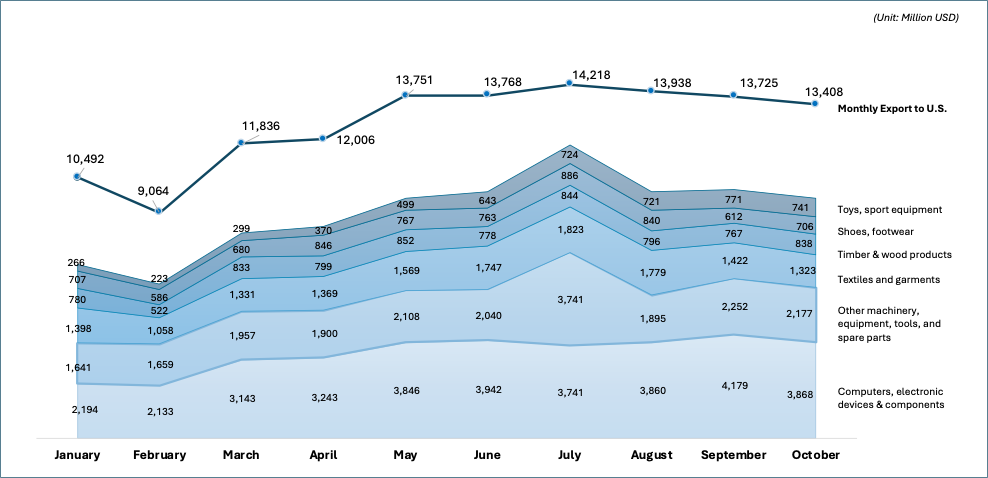

The 20% U.S. import tariff on Vietnamese goods, which took effect on August 7, has begun to show effects in monthly trade data. Data from Vietnam Customs indicate a slowdown in exports to the U.S. between August and October compared with earlier months.

Comparing October with the July peak—prior to the tariff implementation—Vietnam exports to the U.S. fell by 5.7%, reflecting a decline from the earlier surge which was largely driven by front-loading shipments ahead of the impending U.S. tariffs. Despite this, the overall trend remains upward. The impact varies by product groups: exports of computers and electronic components (excluding phones), which account for 27% of Vietnam’s export to the U.S., rose 3.4%, while machinery and equipment fell sharply by 41.8%. Textiles and garments declined 27.4%, footwear fell 20.3%, and timber and wood products dipped 0.7%.

Monthly Exports from Vietnam to the United States (January - October 2025)

Despite these emerging pressures, the overall trade relationship remains substantial and is still on track to exceed last year’s performance. According to Vietnam Customs, from January to October, Vietnam exported USD 126.2 billion to the U.S.—equivalent to 92% of total exports to the U.S. in 2024—while imports from the U.S. reached USD 13.09 billion, a 16% increase compared with the full year 2024. Total bilateral trade reached USD 141.42 billion during the period, already 95% of 2024 levels, resulting in a U.S. trade deficit of USD 110.98 billion for the first 10 months of 2025.

While the full effect of U.S. tariffs will take time to materialize due to reporting lags and ongoing negotiations, the early data suggests selective pressure on tariff-exposed categories. Nevertheless, Vietnam’s broader economic outlook remains resilient. Accelerating GDP growth, surging FDI inflows, and the likelihood of another record year for trade collectively reinforce Vietnam’s position as one of Asia’s most dynamic emerging economies heading into 2026.