Global Pharma Sector Faces Uncertainty Amid U.S. Tariff Threats

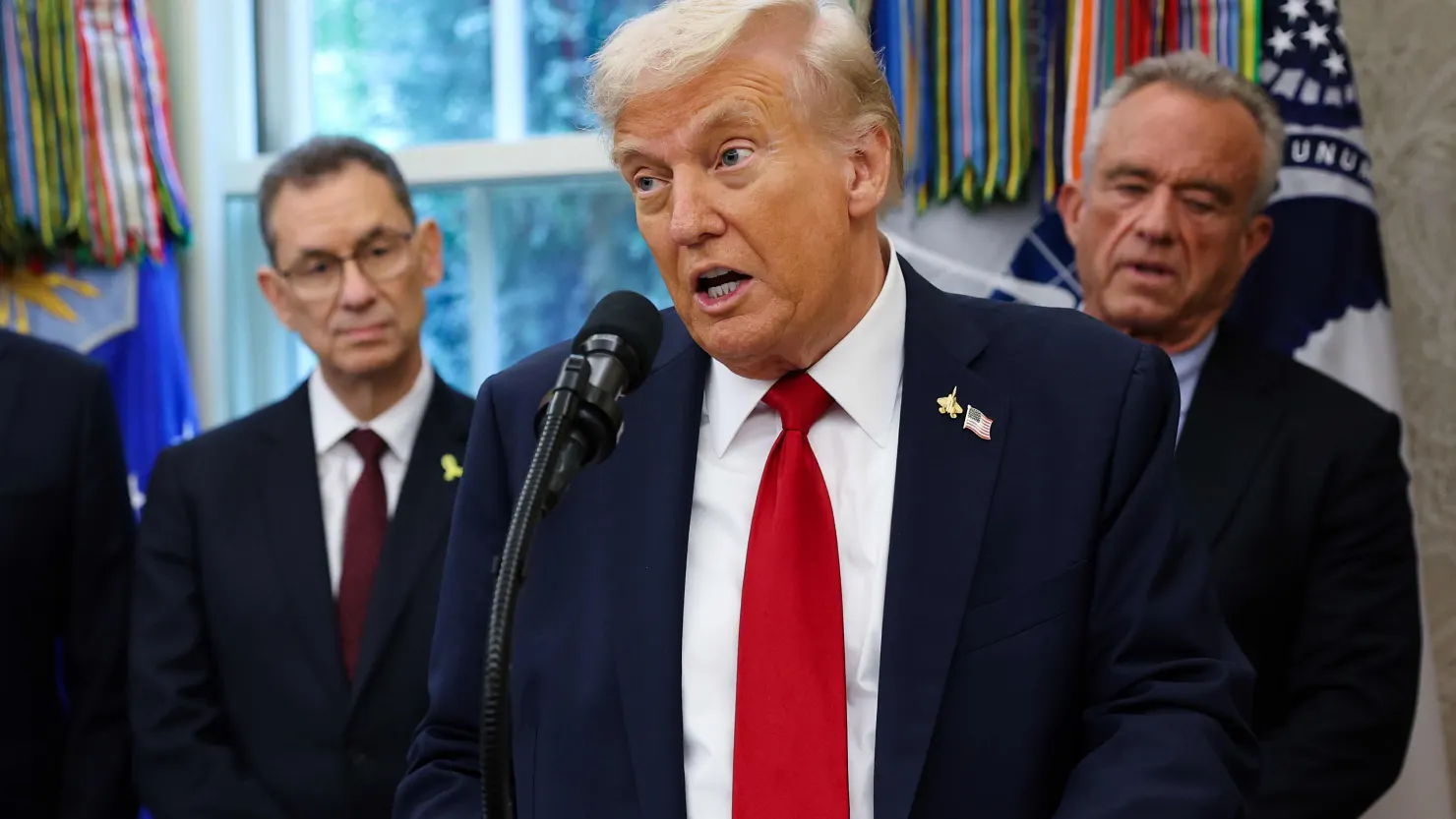

In September, President Trump announced plans to impose a 100% tariff on imported “branded or patented” pharmaceuticals unless manufacturers build production facilities within the United States. Exemptions were included for generic drugs, companies already investing domestically, and those covered by existing trade agreements. The October 1 deadline passed without enforcement, and the administration pivoted toward negotiations with pharmaceutical companies willing to manufacture domestically in the U.S. or adopt most-favored-nation (MFN) pricing.

Pfizer was the first pharmaceutical company to finalize an agreement with the Trump administration on September 30, securing a three-year exemption from the proposed 100% tariff. Under the deal, Pfizer committed to offering its medications to Medicaid programs at the lowest prices charged in comparable developed nations. The company also pledged to launch new drugs at these prices, provide discounted treatments through a new purchasing platform called TrumpRx.gov, and invest US$70 billion in U.S.-based research and manufacturing. AstraZeneca shortly followed Pfizer in securing a deal with the Trump administration on October 10.

In ASEAN, Singapore exports about S$4 billion (US$3.1 billion) in pharmaceutical products to the United States annually, accounting for nearly 13% of its total U.S. shipments. On October 12, Singapore’s Minister of State for Trade and Industry Gan Siow Huang stated in Parliament that discussions are ongoing with the U.S. administration on a preferential tariff arrangement. He also highlighted the sector’s importance to Singapore’s economy, with eight of the world’s top 10 pharmaceutical companies maintaining R&D and manufacturing operations in the country.

Singapore-based pharmaceutical firms are now awaiting clarification from the U.S. administration on whether their expansion and manufacturing plans may qualify for exemptions. While Singapore’s pharmaceutical exports currently face a baseline 10% tariff, lower than most Southeast Asian peers, the threat of the 100% tariff on branded drugs poses a significant risk.