U.S.-ASEAN Relations Remain Pivotal Amidst Shifting Dynamics of Trade and Investment

Background

On April 2, 2025, a date proclaimed by President Donald Trump as “Liberation Day”, the Trump Administration announced sweeping tariffs on American importers of goods and products made in foreign nations. A universal tariff of 10% was imposed on imported goods from around the world on April 5. These were followed by imposing reciprocal import tariffs on goods made in dozens of countries, which took effect in August.

American importers of goods produced in Southeast Asian countries were among the hardest hit by the Trump Administration’s proposed “reciprocal tariffs”. Goods made in Cambodia (49%) and Laos (48%) received the highest proposed rates, followed by Vietnam (46%), Myanmar (44%), and Thailand (36%). Goods made in other Southeast Asian countries received lower proposed import tariff rates: Indonesia (32%), Malaysia and Brunei (24%), and the Philippines (17%). Singapore which has a two-decade old bilateral free trade agreement with the United States that set tariff rates on American importers of goods made in Singaporean at 0%, now have a tariff rate of 10%.

Following the announcement of the proposed reciprocal tariff rates on goods made in ASEAN, Southeast Asian governments proceeded to negotiate with the Trump Administration. Vietnam was the first ASEAN nation to secure a reciprocal tariff framework deal on July 3, reducing the proposed tariff rate on American importers of goods made in Vietnam to 20%. Indonesia, Malaysia and the Philippines also concluded negotiations for framework deals in late July which set 19% tariff rates on American importers of goods from those countries. Final tariffs on American importers went into force on August 1, with Laos, Myanmar, and Brunei seeing no major changes from the proposed April 1 rates - Laos and Myanmar at 40%, and Brunei at 25%.

U.S. Tariffs on ASEAN countries (as of October 7, 2025)

| April 2 Announced Tariff Rates Country | Tariff Rate Effective April 9, 2025 | Tariff Rate based on POTUS July formal letters, Effective August 1 | Tariff Rate Effective August 7, 2025 |

| Brunei | 24% | 25% | 25% |

| Cambodia | 49% | 36% | |

| Indonesia | 32% | 32% | 19% |

| Laos | 48% | 40% | 40% |

| Malaysia | 24% | 25% | 19% |

| Myanmar | 44% | 40% | 40% |

| Philippines | 17% | 20% | 19% |

| Singapore | 10% | No Letter | 10% |

| Thailand | 36% | 36% | |

| Timor-Leste | 10% | No Letter | 10% |

| Vietnam | 46% | No Letter | 20% |

Source: US-ASEAN Business Council

Timely Response from ASEAN with Regional Engagements

As a strategic response to U.S. tariffs, the ASEAN Economic Ministers (AEM) assembled the ASEAN Geoeconomic Task Force (AGTF) to monitor U.S. policy changes and mitigate impacts on trade, investment, global supply chains, and the private sector. During a special session in April, the AEM agreed on a three-pronged approach: engage the U.S. constructively, reaffirm multilateral commitment based on the WTO’s framework, and build internal and regional resilience to withstand external shocks. The AGTF is a key part of ASEAN’s adaptation strategy by facilitating a space for the government and private sector to monitor, evaluate, and propose policies that strengthen ASEAN’s economic resilience. The AGTF is expected to present its findings and recommendations to a joint session of the ASEAN Foreign Ministers (AFM) and AEM, taking place ahead of the 47th ASEAN Summit this October.

The AGTF Roundtable, co-hosted by ERIA and ASEAN BAC on August 11, focused on strengthening ASEAN’s economic resilience through trade diversification, innovation-driven growth, and regional integration. Key proposals included the ASEAN Business Entity (ABE) framework to facilitate cross-border movement and unify industrial policy, as well as calls for domestic reforms in countries like Vietnam and Indonesia to improve regulatory efficiency. Additionally, there was emphasis on leveraging existing trade agreements like RCEP and ATIGA. These developments signal a more open, integrated, and reform-oriented ASEAN market - creating new opportunities for U.S. companies to expand operations, tap into regional supply chains, and benefit from streamlined regulations and trade frameworks.

During the ASEAN Economic Ministers–U.S. Trade Representative (AEM-USTR) Consultation at the 57th AEM Meeting on September 24, the session reaffirmed support for implementing the 2024–2025 ASEAN-U.S. Trade and Investment Framework Arrangement (TIFA) Work Plan. This reflects the shared commitment of both parties to deepen engagement and strengthen regional supply chains, paving the way for a more resilient and mutually beneficial economic partnership.

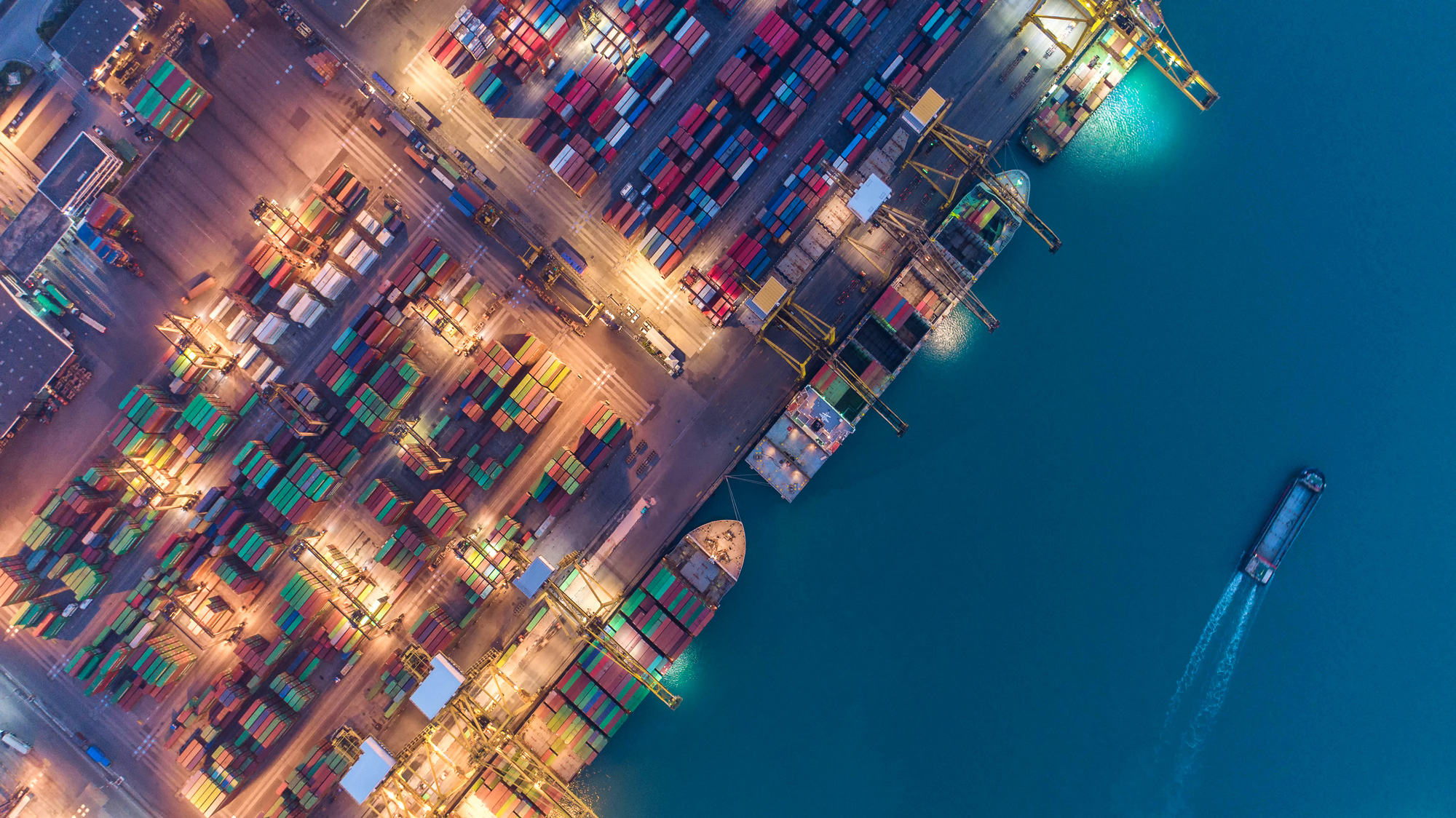

Strengthening U.S.-ASEAN Trade Through Private Sector Advocacy

ASEAN’s economic significance has grown over the past decade, with it being the U.S.’ fourth-largest trading partner. The U.S. is also ASEAN’s largest source of foreign direct investment (FDI), totaling $42.1 billion of inflow in 2024. There are more than 6,000 U.S. companies that operate in ASEAN, and US-ASEAN trade and investment supports 625,000 jobs in the US-ASEAN supply chains present tremendous potential – particularly next-generation technology supply chains. Indonesia, Philippines, Myanmar, Thailand, and Vietnam have vast reserves of nickel, copper, cobalt, rare earths, and other minerals. While development in this sector is still early in its stage, with most of the focus on extraction, these countries can still play a significant role as the U.S. diversifies its supply of these resources.

As ASEAN’s strategic value grows, there is an urgent need for structured engagement to assist U.S. businesses in navigating shifting trade dynamics. Recognizing this need, USABC launched the U.S. Trade and Tariffs Working Group (TTWG), focusing on providing members with a platform to engage directly with the U.S. and ASEAN government stakeholders, shape negotiation outcomes, and advocate for the removal of non-tariff barriers. The TTWG also plays a role in multilateral coordination, including discussions with the AGTF, to ensure that private sector perspectives are incorporated into regional policy responses.

Since its launch, the TTWG has hosted three member listening sessions to provide updates on U.S.-ASEAN trade negotiations and, together with the U.S. Chamber of Commerce, convened a luncheon with Singapore’s Deputy Prime Minister Gan Kim Yong to discuss concerns over U.S. tariff policies and their impact on business confidence. To further capture member perspectives, the TTWG also conducted a survey on “Navigating U.S. Tariffs and Global Trade Challenges” and will soon launch another on product exemptions and their effects on member operations in ASEAN.